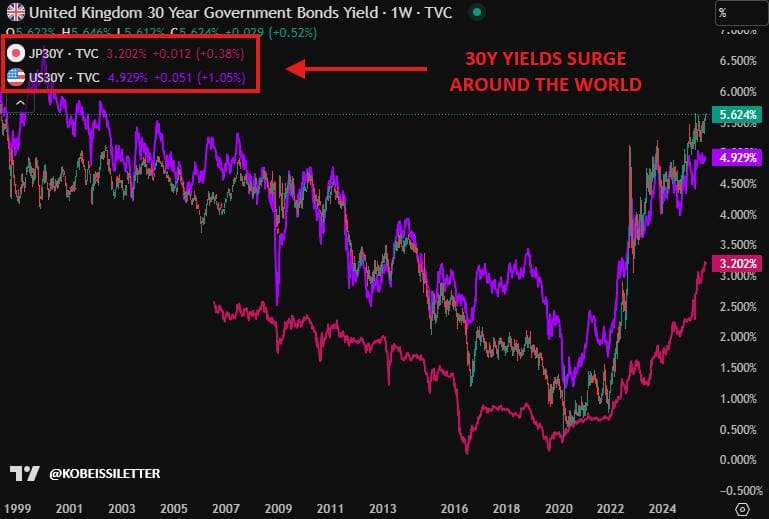

Japan"s 30-year bond yield has surged above 3.20% for the first time in history, marking a significant milestone in the nation"s financial landscape. This unprecedented rise comes as global markets grapple with rising interest rates and inflationary pressures.

The implications of this yield spike extend beyond Japan. In the United States, 30-year yields are on track to breach the 5.00% mark, following closely behind the UK’s turbulent bond market. As governments face mounting deficits, experts warn that fiscal challenges are intensifying, leading to a potential crisis in bond markets.

Gold prices have reacted sharply to these developments, surging over 30% year-to-date and outpacing the S&P 500’s returns by a considerable margin. Analysts suggest that the Federal Reserve may soon cut rates despite inflation exceeding 3%, further fueling interest in gold as a safe-haven asset. This aligns with recent developments indicating a global shift by central banks towards increasing gold reserves.

As the financial landscape evolves, investors are closely monitoring these trends, particularly the potential for escalating fiscal crises and their impact on global markets. With Japan setting a historic precedent, the world watches to see how this will influence other economies.

![[Video] Gunfire between Iraqi security forces and Sadr militias in Baghdad](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1768343508874-4redb-thumbnail.jpg&w=3840&q=75)