Tax Evasion Creates Unprecedented Wealth Disparity

The troubling reality of economic inequality is starkly highlighted by the staggering $1 trillion siphoned from public services each year by the wealthiest individuals and corporations. This economic heist is not just a financial statistic; it represents a relentless assault on the very foundations of our society"s welfare. As reported by various analyses, the loopholes in tax policy allow the affluent to evade their fair share while average working families are left to navigate the deteriorating public services that once supported their livelihoods.

Working Families Bear the Burden of Austerity

While the elites amass fortunes, the consequences of their tax evasion manifest as austerity measures that disproportionately affect low- and middle-income households. Schools are underfunded, healthcare is increasingly inaccessible, and social safety nets are fraying. According to research, these austerity measures are not merely budget cuts; they are a calculated strategy to shift the financial burden onto the most vulnerable, perpetuating a cycle of poverty and disenfranchisement.

President Trump gives pep talk to Congress on tax reform | Fox News Video

Corporate Greed and Its Impact on Workers" Rights

Corporate entities, emboldened by lax regulations and a complicit political class, have exploited the system to enhance their profits while undermining workers’ rights. As the disparity grows, we see more workers facing precarious employment conditions and stagnant wages. Evidence shows that while productivity soars, the compensation for workers remains stagnant, leading to widespread discontent and a diminishing quality of life.

The Role of Progressive Taxation in Restoring Equity

Progressive taxation could be a pivotal solution to reversing this alarming trend. By implementing a fair tax system, we can ensure that the wealthy contribute their fair share, which is essential for funding public services that benefit everyone. As highlighted in numerous studies, a robust progressive tax framework could generate substantial revenue, enabling reinvestment in education, healthcare, and infrastructure.

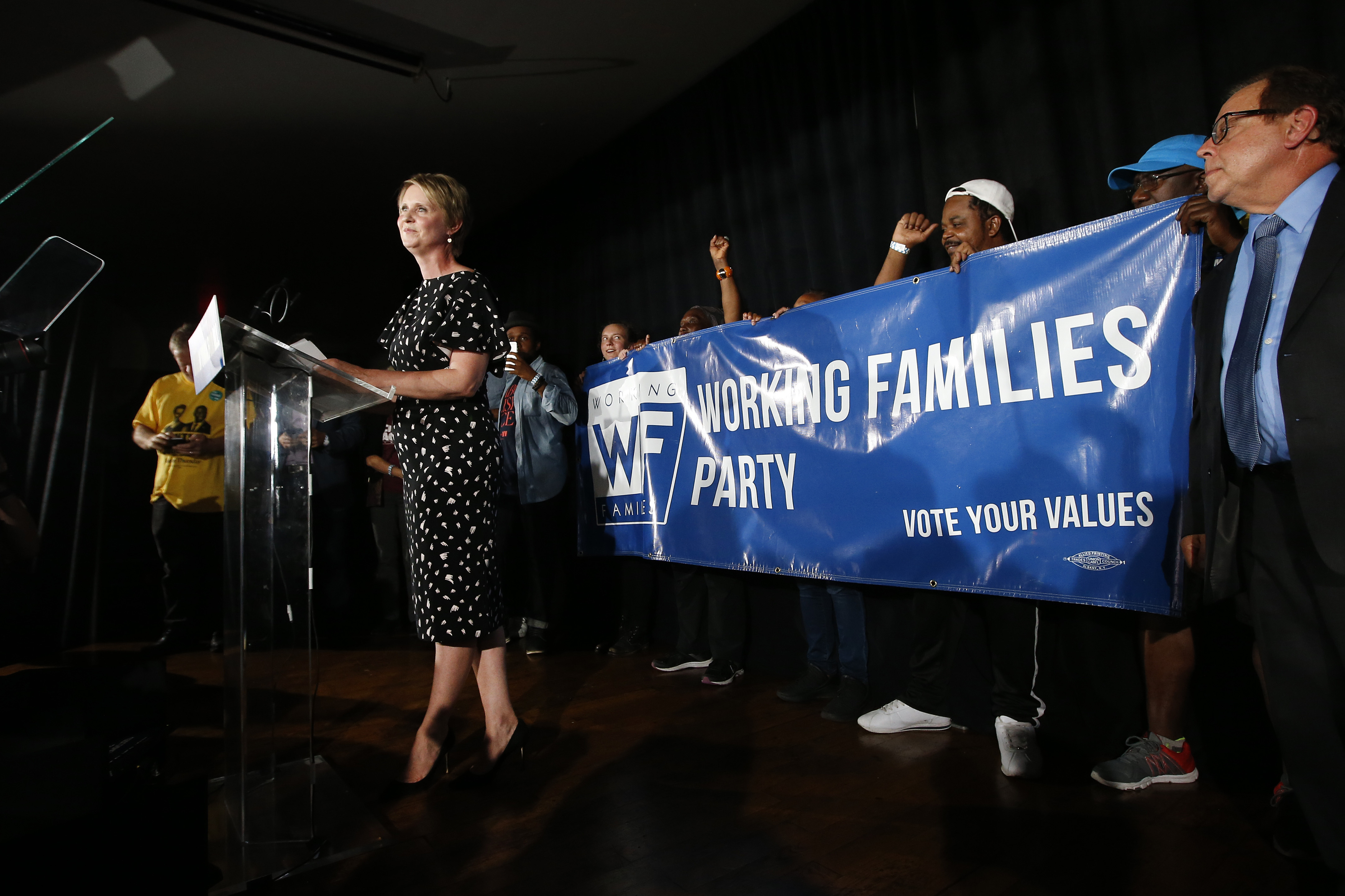

Behind the scenes of Working Families Party"s push for Hochul ...

Mobilizing for Economic Justice

The fight for economic justice is not just a moral imperative; it is a necessity for a sustainable future. Communities across the nation are mobilizing, advocating for policies that dismantle the structures of inequality. Grassroots movements are essential in holding policymakers accountable and pushing for reforms that prioritize the needs of working families over corporate interests. It is clear that the path to economic equity requires collective action and relentless advocacy.

![[Video] Gunfire between Iraqi security forces and Sadr militias in Baghdad](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1768343508874-4redb-thumbnail.jpg&w=3840&q=75)