Japan’s Government Pension Investment Fund (GPIF) has reported a staggering loss of $61.1 billion for the first quarter of 2025, marking its first quarterly downturn since mid-2022. This catastrophic decline is largely attributed to the plummeting value of the US dollar and rampant global market volatility, raising critical questions about the sustainability of pension funds heavily invested in foreign assets.

Impact of Currency Fluctuations on Pension Assets

With nearly 50% of its $1.5 trillion assets under management allocated to overseas markets, GPIF is highly vulnerable to currency swings. As reported by Japan Times, the dollar"s decline in early 2025 was the worst since 1973, leading to significant depreciation in the value of GPIF’s foreign bonds and equities. This situation doesn"t just affect the fund’s bottom line; it threatens the retirement security of millions of Japanese workers counting on these pensions for their future.

Geopolitical Tensions Add to Financial Strain

The recent turmoil in the global market is compounded by escalating trade tensions between the US and Japan. According to Japan Times, these uncertainties have not only depressed asset prices but also raised alarm among investors about the GPIF’s long-term investment strategy. The fund’s leadership insists on a long-term perspective, yet the reality is that many pensioners face immediate economic challenges.

\n\n

Tokyo: A Global Financial Hub

Passive Investment Strategy Under Fire

GPIF maintains a strategy of passive investment management, with over 80% of its equity investments tied to major indices to minimize costs. While this approach has historically provided stable returns, the current market conditions call into question whether such a strategy is appropriate for a volatile global environment. There are calls for a reevaluation of GPIF’s asset allocation, especially regarding its exposure to US equities and bonds.

Historical Context of Fund Losses

This $61 billion loss is not an isolated incident. The GPIF has faced significant quarterly losses in the past, including a record $136 billion drop in 2019 and a $165 billion loss during the COVID-19 pandemic. Each setback raises urgent concerns about the inherent risks tied to managing a portfolio of this magnitude, particularly in times of economic uncertainty.

\n\n

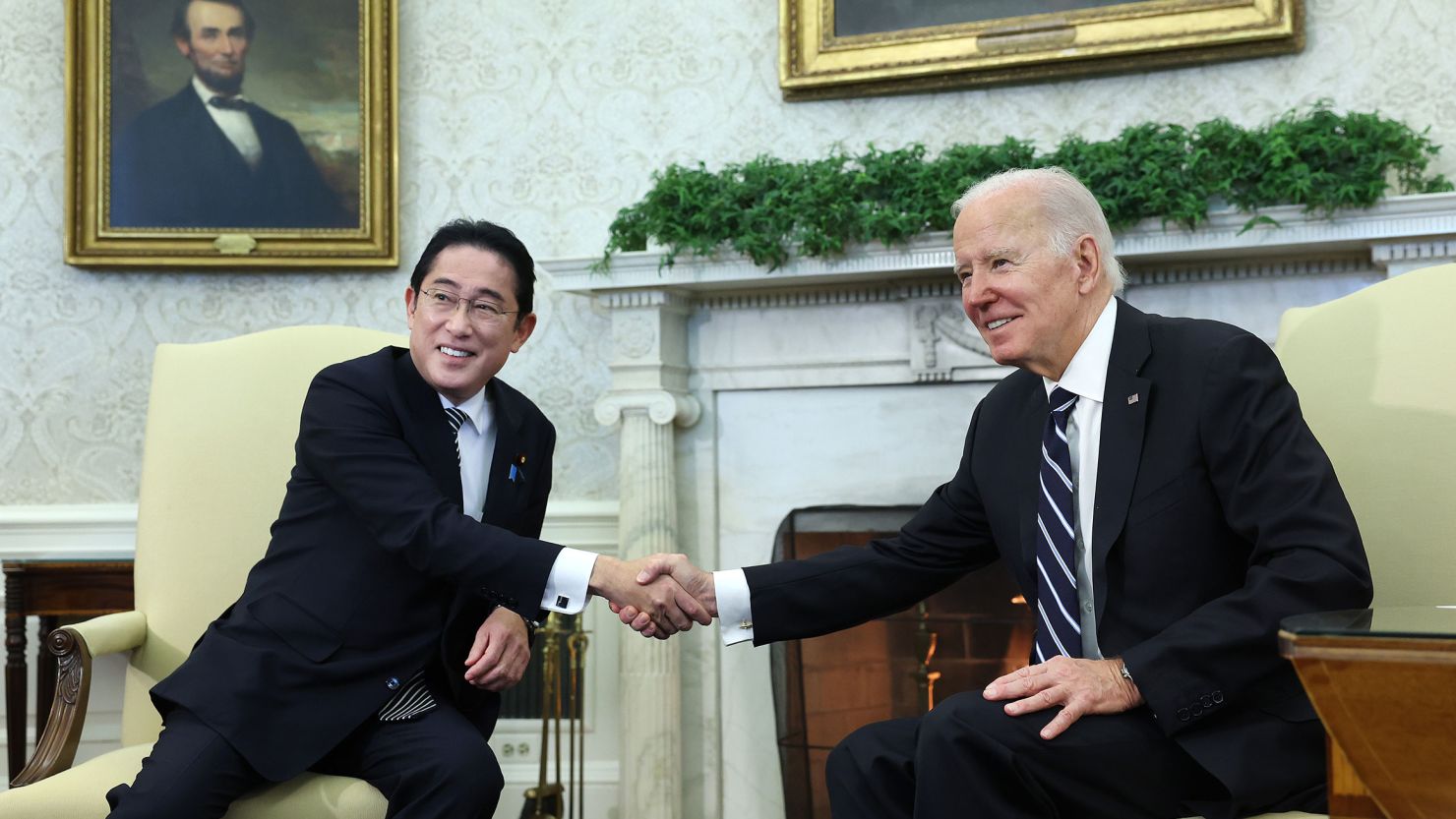

Japanese prime minister"s visit spotlights Biden"s foreign ...

Calls for Accountability and Reform

As the GPIF grapples with these financial setbacks, there is a growing demand for accountability and reform within the pension system. Stakeholders, including labor unions and environmental advocates, argue that pension funds should not only focus on financial returns but also consider social and environmental impacts. The current situation highlights the need for a shift towards sustainable investments that reflect the values and needs of the communities they serve.

The GPIF’s loss serves as a stark reminder of the fragility of financial systems that prioritize profit over people. As the fund navigates through this turbulent landscape, the voices of workers and the marginalized must be amplified to ensure their needs are prioritized in future investment decisions.

![[Video] Gunfire between Iraqi security forces and Sadr militias in Baghdad](/_next/image?url=%2Fapi%2Fimage%2Fthumbnails%2Fthumbnail-1768343508874-4redb-thumbnail.jpg&w=3840&q=75)